Read

Edit

History

Notify

Share

Credbull

Credbull Credbull is a decentralized lending platform that offers stable high yields in private credit without the volatility typically associated with cryptocurrency investments. It provides global access to lending products in private credit with risk-adjusted high Annual Percentage Yield (APY).[1]

Overview

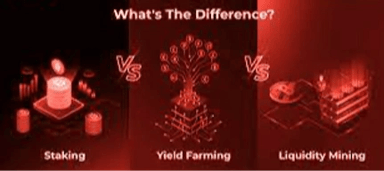

Credbull addresses key challenges in the decentralized finance (DeFi) space, particularly the high correlation of most DeFi assets with Bitcoin price movements and the elevated counterparty and protocol-level risks often associated with high DeFi yields. The platform aims to bring private credit high fixed yield solutions on-chain in a fully transparent and accessible manner, catering to both retail and institutional investors.[2]

The core offering of Credbull is its licensed on-chain private credit fund, which emphasizes governance and transparency in strategy, risk management, and off-chain asset allocation. This approach allows investors to access private credit opportunities that have traditionally been reserved for institutional and accredited investors in traditional finance (TradFi).[2]

Key Features

- Credbull manages the first licensed on-chain private credit fund, bringing the entire fund on-chain for unparalleled transparency and accessibility.[3]

- The platform offers real-time visibility into its strategy, risk management, and performance, as well as capital allocation by Originator, product, and all SME transactions.[3]

- Credbull provides stable returns in volatile markets through targeted asset allocation and robust risk management strategies.[3]

- Investors can choose lock-up periods that best suit their liquidity needs, enhancing customization and accessibility.[3]

- The Credbull On-Chain Private Credit Fund 1 eliminates high minimum investment barriers, offering no minimum investment requirement.[2]

- The fund offers two tenure options: 1. Six-month term with an 8% Fixed APY and 20% upside participation based on fund performance

- Twelve-month term with a 10% Fixed Yield and 30% upside participation in fund performance[2]

- Credbull deploys its DeFi vaults on multiple EVM chains, serving some of the largest communities in Web3.[2]

How It Works

Credbull's On-Chain Private Credit Fund 1 deploys capital to established SME Lending Originators who offer a variety of credit products to creditworthy Small & Medium Size Enterprises (SMEs). This generates substantial yield from a diversified portfolio of over a million creditworthy SME transactions annually, with a historical default rate of less than 2.0%.[2]

The fund flow process involves:

- Lenders providing capital to the fund

- Transparent deployment of capital to SME Originators

- Allocation by Product

- Distribution to SME Transactions[3] Credbull issues 'Claim Tokens' for self-custody, empowering decentralized governance and establishing new standards for transparency and accountability in the industry.[3]

Technology

Credbull's platform is designed to be permissionless in its second phase, allowing anyone or any entity to build on top of it. The platform also focuses on providing liquidity and composability to its products, enabling investors to draw leverage and transfer their ERC4626 Claim Tokens peer-to-peer within Credbull's ecosystem.[2]

Community Engagement

Credbull has developed a gamified app called inCredbull Earn, where users can participate in various investment-themed activities and be rewarded with the native $CBL token. The community is also involved in the governance of the token ecosystem and participates in key platform features.[2]

Strategic Partners and Backers

Credbull has partnerships with several notable organizations in the blockchain and finance space, including Plume, Gnosis, HODL, Outlier, CryptoHedge, Nest, Centrifuge, Mountain, Ondo, and Anemoy.[1]

In conclusion, Credbull represents a significant innovation in the DeFi space, bridging the gap between traditional private credit investments and blockchain technology. By offering transparent, accessible, and high-yield investment opportunities, Credbull aims to reshape both the TradFi and DeFi landscapes.

Credbull

Commit Info

Edited By

Edited On

February 27, 2025

Feedback

Average Rating

How was your experience?

Give this wiki a quick rating to let us know!

Media

REFERENCES

[1]

[2]

Much of DeFi is highly correlated. When Bitcoin (BTC) prices move, the rest of the market typically follows, leading to unmanaged volatility and exposing portfolios to significant risk. Pursuing high DeFi yields through recent innovations often entails elevated levels of counterparty and protocol-le...

Feb 25, 2025

[3]

Credbull's Licensed On-chain Private Credit Fund represents a groundbreaking advancement in decentralized finance (DeFi), providing unparalleled transparency and accessibility to investors by bringing the entire fund on-chain. Unlike traditional Real World Asset (RWA) investment opportunities that o...

Feb 25, 2025