Read

Edit

History

Notify

Share

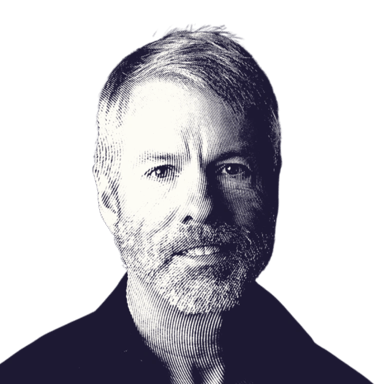

Michael Saylor

Michael Saylor is an American entrepreneur, executive, and Bitcoin advocate who co-founded MicroStrategy, a business intelligence company, in 1989. He is widely recognized for his pioneering corporate strategy of converting MicroStrategy's treasury reserves into Bitcoin and his outspoken advocacy for cryptocurrency adoption.

Overview

Michael J. Saylor has served as the Executive Chairman of MicroStrategy since August 2022 and previously held the position of Chief Executive Officer from 1989 to 2022. He co-founded MicroStrategy with Sanju Bansal, establishing the company as a global leader in enterprise analytics and mobility software. Saylor's career trajectory shifted dramatically in 2020 when he led MicroStrategy to become the first publicly traded company to adopt Bitcoin as its primary treasury reserve asset, a move that transformed both his public profile and the company's business strategy. [1]

Saylor graduated from the Massachusetts Institute of Technology (MIT) with a double major in Aeronautics and Astronautics, and Science, Technology, and Society. His academic background, combined with his entrepreneurial vision, positioned him to lead MicroStrategy through multiple technological transitions over more than three decades. Under his leadership, MicroStrategy evolved from a software consulting firm to a global enterprise software company, and later into a significant corporate holder of Bitcoin. [1]

Beyond his corporate role, Saylor has become one of the most prominent advocates for Bitcoin in the business world, frequently appearing in financial media to discuss cryptocurrency investment strategies and monetary theory. His public commentary often focuses on Bitcoin as a store of value and hedge against inflation, concepts he has elaborated on through numerous interviews, conference appearances, and his active social media presence. [2]

Career at MicroStrategy

Early Years and Company Founding

Michael Saylor co-founded MicroStrategy in 1989 with Sanju Bansal, whom he met while studying at MIT. The company initially focused on data mining and business intelligence software, providing consulting services to corporations. Saylor's technical background and business acumen helped guide the company through its early development phase, establishing it as an innovative player in the emerging field of business intelligence. [1]

Under Saylor's leadership, MicroStrategy went public in June 1998, with shares opening at $12 and rising to $333 by early 2000. This success briefly made Saylor one of the wealthiest individuals in the world, with his net worth reportedly reaching $7 billion at its peak. [3]

Dot-com Era Challenges

In March 2000, MicroStrategy announced accounting regularities that required the company to restate its financial results for the preceding two years. This announcement coincided with the broader dot-com crash, leading to a significant decline in MicroStrategy's stock price. The Securities and Exchange Commission (SEC) subsequently charged Saylor and two other MicroStrategy executives with civil accounting fraud. Without admitting wrongdoing, Saylor and his colleagues settled the charges by paying $10 million in penalties and returning $10 million in alleged ill-gotten gains. [3]

Despite this setback, Saylor maintained his position as CEO and worked to rebuild MicroStrategy's reputation and business over the following decades. The company continued to develop its business intelligence software and expanded into mobile software applications.

Transition to Executive Chairman

In August 2022, Saylor transitioned from his role as CEO to become Executive Chairman of MicroStrategy, a position created to allow him to focus more directly on the company's Bitcoin acquisition strategy and advocacy. Phong Le, who had been serving as President, assumed the CEO position. This organizational change reflected the company's evolving priorities and Saylor's increasing focus on Bitcoin as a corporate strategy. [1]

Bitcoin Strategy and Advocacy

Corporate Bitcoin Adoption

In August 2020, Saylor led MicroStrategy to make its first significant Bitcoin purchase, acquiring 21,454 bitcoins for $250 million as part of a new capital allocation strategy. This decision marked a pivotal moment for both MicroStrategy and corporate Bitcoin adoption more broadly. Saylor explained the move as a response to macroeconomic factors, including monetary inflation, global economic and political uncertainty, and the negative real returns on conventional assets. [4]

Following this initial purchase, MicroStrategy continued to acquire Bitcoin, eventually becoming the largest corporate holder of the cryptocurrency. The company has raised capital through convertible note offerings and equity sales specifically to fund additional Bitcoin purchases, demonstrating Saylor's commitment to this strategy. As of early 2023, MicroStrategy held over 130,000 bitcoins, representing billions of dollars in value. [3]

Bitcoin Philosophy and Public Advocacy

Saylor has articulated a comprehensive philosophy regarding Bitcoin, describing it as "digital gold" and the first truly scarce digital asset. He frequently discusses Bitcoin in terms of monetary energy and store of value, arguing that its fixed supply of 21 million coins makes it an ideal treasury reserve asset in an environment of expanding fiat money supply. [2]

"Bitcoin is a swarm of cyber hornets serving the goddess of wisdom, feeding on the fire of truth, exponentially growing ever smarter, faster, and stronger behind a wall of encrypted energy," Saylor stated in one of his more colorful descriptions of the cryptocurrency. [2]

Saylor has become a prolific speaker at Bitcoin conferences and financial events, where he often presents detailed analyses of monetary history, inflation, and the technical aspects of Bitcoin. His advocacy extends to social media, particularly Twitter (now X), where he regularly shares Bitcoin-related content and engages with the cryptocurrency community. [2]

Educational Initiatives

The Saylor Academy

In 1999, Saylor established the Saylor Foundation, which later became the Saylor Academy, a non-profit organization providing free online education. The academy offers over 100 college-level courses across various disciplines, aligning with Saylor's interest in expanding access to education through technology. This initiative predates his involvement with Bitcoin but reflects his broader interest in using technology to create positive social impact. [4]

Bitcoin Education

Since becoming a Bitcoin advocate, Saylor has dedicated significant effort to educating corporate executives, investors, and the general public about Bitcoin. He has developed and shared frameworks for understanding Bitcoin as a treasury reserve asset and frequently conducts interviews and educational sessions explaining complex cryptocurrency concepts in accessible terms. [2]

In February 2021, MicroStrategy hosted a "Bitcoin for Corporations" conference, providing resources for companies interested in adding Bitcoin to their balance sheets. This event attracted thousands of corporate representatives and demonstrated Saylor's commitment to expanding institutional adoption of Bitcoin. [4]

Personal Wealth and Recognition

Saylor's net worth has fluctuated significantly throughout his career, reaching billions during the dot-com boom, declining after the 2000 crash, and then rising again with MicroStrategy's Bitcoin investments and the cryptocurrency's price appreciation. As of 2023, Forbes estimated his net worth at approximately $1.6 billion, with much of his wealth tied to his MicroStrategy holdings and personal Bitcoin investments. [3]

Beyond his business achievements, Saylor has received recognition for his thought leadership in technology and cryptocurrency. He has authored or co-authored books including "The Mobile Wave: How Mobile Intelligence Will Change Everything" (2012), which explored the transformative impact of mobile computing before his focus shifted to Bitcoin. [1]

Controversies and Criticisms

Saylor's Bitcoin strategy has attracted both praise and criticism. Supporters view his approach as visionary and prescient, while critics have expressed concerns about the concentration of corporate resources in a volatile asset class. Some financial analysts have questioned the wisdom of converting such a large portion of MicroStrategy's treasury to Bitcoin, citing the cryptocurrency's price volatility and regulatory uncertainties. [3]

The SEC investigation and settlement regarding MicroStrategy's accounting practices in 2000 remains a notable controversy in Saylor's career, though he successfully maintained his leadership position at the company in the aftermath. [3]

More recently, Saylor and MicroStrategy faced a personal tax lawsuit from the District of Columbia, which alleged that Saylor had improperly avoided D.C. income taxes despite living there. The case highlighted the complex tax implications for wealthy individuals with multiple residences. [3]

Legacy and Influence

Michael Saylor's decision to adopt Bitcoin as a treasury reserve asset has influenced other companies and institutional investors to consider cryptocurrency allocations. His articulate advocacy has helped legitimize Bitcoin as a corporate treasury option and contributed to broader institutional acceptance of digital assets. [4]

As one of the most visible and vocal Bitcoin proponents in the business world, Saylor has played a significant role in shaping public discourse around cryptocurrency. His technical background and experience as a long-term CEO have lent credibility to his perspectives on Bitcoin's potential as a store of value and inflation hedge. [2]

Whether viewed as a visionary or a risk-taker, Saylor's impact on corporate Bitcoin adoption and the broader cryptocurrency ecosystem is substantial and continues to evolve as digital asset markets mature. [3]

Michael Saylor

Commit Info

Feedback

Average Rating

How was your experience?

Give this wiki a quick rating to let us know!

Media

REFERENCES

[1]

[2]

[3]

[4]